2020 Federal Budget Announcement

The 2020 Federal Budget Announcement on 6 October included significant measures to encourage consumer spending and drive the economy out of its current state. The key areas are summarised below, of which several have already passed through legislation.

Inclusions in the Tax Bill (Passed)

Personal income tax cuts

Personal income tax cuts will now be brought forward and backdated to 1 July this year. There are two key parts:

Part 1 – A larger 2021 tax refund (in most circumstances) to account for the extra tax withheld in the July-Oct 2020 period.

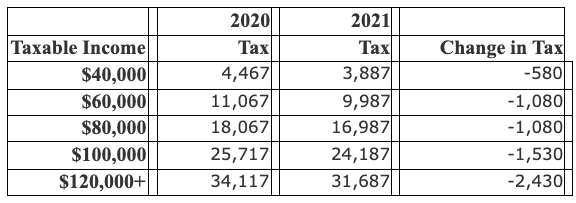

Part 2 – A reduction in tax withheld from wages going forward giving a bigger net pay packet. This will start in the next few weeks. Here is an example of what you can expect:

Non-employees should consider varying PAYG Instalments to account for the cuts from September onward.

Instant asset write-off

This will allow any business with an aggregated turnover of less than $5 billion to immediately deduct the full cost of eligible depreciable assets of any value from 6 Oct 2020 which are installed and ready for use prior to 30 June 2022.

Second-hand assets are excluded from this measure, however small and medium-sized businesses with an annual turnover of less than $50 million will be able to fully expense second-hand assets.

Loss carry-back

Companies will be able to carry back tax losses from the 2019–20, 2020–21 or 2021–22 income years to offset against tax paid in a previous income year as far back as the 2018–19 income year. The applicable offset will be called a 'Loss Carry-back Tax Offset' and is available to companies earning less than $5 billion.

The tax refund will be limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry-back does not generate a franking account deficit.

Small business concessions expansion

Entities with a turnover of less than $50 million will also now be able to access 10 small business tax concessions (this was previously capped at $10 million):

- access an immediate deduction for certain prepaid expenses from 1 July 2020

- access an immediate deduction for certain start-up expenses from 1 July 2020

- access to a fringe benefits tax exemption in relation to small business car parking from 1 April 2021

- access to a fringe benefits tax exemption in relation to the provision of multiple work-related portable electronic devices from 1 April 2021

- access to a simplified accounting method for the purposes of GST from 1 July 2021

- ability to defer excise-equivalent customs duty to a monthly reporting cycle from 1 July 2021

- ability to defer excise duty to a monthly reporting cycle from 1 July 2021

- a two-year amendment period in respect of amendments to income tax assessments from 1 July 2021

- access to the simplified trading stock rules from 1 July 2021

- ability to pay PAYG instalments based on GDP-adjusted notional tax from 1 July 2021

R&D tax incentive

For companies with a turnover of less than $20 million, there will be no cap on the amount of refundable R&D tax offset a company can claim.

The refundable R&D tax offset for small companies will also be set at 18.5 percentage points above the claimant's company tax rate (up from 13.5 per cent from the current bill).

Larger companies with an annual turnover of $20 million or more will face a simplified two-tier intensity approach.

Other Federal Budget Announcements

Small Business Pooling – Immediate Write Off

Small business entities that have a turnover of less than $10 million and are using the pooling system can claim the balance of their depreciation pool at the end of the 2021 year as a deduction.

This means that all remaining depreciation can be claimed in 2021 but also means there is no further depreciation claim for assets previously purchased. It also means that proceeds on the sale of any depreciated assets are 100% taxable.

JobMaker

A credit will be available to eligible employers for additional new jobs they create for an eligible employee. The credit will be $200 per week for employees aged 16-29 and $100 per week for employees aged 30-35 and is payable over a 12 month period.

To be eligible, the employee will have to work a minimum of 20 hours per week and have received JobSeeker, Youth Allowance or Parenting Payment for at least one month out of the three months prior to start date.

Employers will also need to prove that the new employee will increase overall headcount and payroll.

Apprenticeship Commencements

A 50% wages subsidy will be available to businesses who take on a new or recommencing Australian apprentice, up to a maximum of $7,000 per quarter.

Economic Support Payments

For those people who receive a range of government payments, including aged pension, carer payment and family tax benefit, they will receive two $250 cash payments paid in December and March 2021.

Fringe Benefits Tax

The record keeping burden for FBT purposes will be reduced and an exemption will be provided for retraining and reskilling benefits that employers provide to redundant, or soon to be redundant employees where the benefits may not be related to their current employment.

Water Infrastructure Grants

This year's Budget includes $50 million to top up the on-farm emergency water rebate scheme that provides farmers with a rebate of up to $25,000 to clean dams and drill bores, which ran out of money 18 months early. This funding is contingent on being matched by the states.